Contents:

These are always the easiest to adopt as they’re already integrated with your website. You could also use third-party payment solutions like Stripe. As a freelance writer, I rarely work with clients in person. In fact, I’ve only ever officially met one of my clients — the rest I work with purely over email. Because of that, I collect most of my payments through an online gateway.

A Beginner’s Guide to Using Contra Asset Accounts – The Motley Fool

A Beginner’s Guide to Using Contra Asset Accounts.

Posted: Fri, 05 Aug 2022 07:00:00 GMT [source]

Under the double-entry system, the transaction needs to be entered as a credit in one account and as a debit in another account. Entered on the right side of the ledger or account are credits. And likewise, credits can increase some accounts and decrease others.

Overview: What is small business accounting?

Accounting RatiosAccounting ratios measure the company’s financial health by comparing the various elements of the financial statements to gauge the organization’s progress over the period. There are four types of accounting ratios- liquidity, solvency, profitability and activity ratios. The accounts for assets, liabilities, and shareholders’ equity all break into smaller components that help break down the company’s finances.

But that doesn’t mean that each debit and credit balance on a dollar basis. A debit doesn’t always mean diminishing the account, and likewise, crediting an account doesn’t mean its value will increase. On the other side, the loan increases the restaurant’s liabilities, and this transaction, where the liabilities increase, is the credit transaction.

- Current LiabilitiesCurrent Liabilities are the payables which are likely to settled within twelve months of reporting.

- If only bookkeeping meant hoarding the paperbacks I overbuy from my local bookstore — I’d be really good at that.

- Accounting is popularly regarded as “the language of business” because it doesn’t just help you keep track of your money, but also helps you make informed decisions about your business.

- This process is greatly simplified when you use accounting software, but can also be done by hand relatively simply.

- A user-friendly option for small business accounting, FreshBooks makes it easy to track income and expenses and includes a self-employed version just for you.

Managerial accounting is designed around the needs of managers and not necessarily regulated. It is for internal purposes and may employ any useful accounting system. Once the financial statements are compiled, the data may be analyzed using ratios and financial analysis. Accounting can provide powerful information to all stakeholders when properly maintained and interpreted. Understanding the basic accounting equation is the relationship between assets, debt, and capital owned by the company.

Accounting is key to the success of small business ventures. But not all small business owners can pursue formal financial training. Your method of collecting money is often referred to as your payment gateway. Whether you provide freelance services, set up shop at a local farmer’s market, or run a global e-commerce business, you need an easy way to collect what you’ve earned. Not only will this help offset some upfront expenses, but it will also contribute to your business’s overall credit.

Ways To Manage Your Business Accounting

Accordingly, the carrying amount may differ from the market value of assets. This means that, regardless of when the actual transaction is made, the expenses that are entered into the debit side of the accounts should have a corresponding credit entry in the same period. Retained Earnings will increase when the corporation earns a profit. There will be a decrease when the corporation has a net loss.

Some of the basic accounting terms that you will learn include revenues, expenses, assets, liabilities, income statement, balance sheet, and statement of cash flows. You will become familiar with accounting debits and credits as we show you how to record transactions. You will also see why two basic accounting principles, the revenue recognition principle and the matching principle, assure that a company’s income statement reports a company’s profitability. This is the practice of recording and reporting financial transactions and cash flows. This type of accounting is particularly needed to generate financial reports for the sake of external individuals and government agencies.

Accounting Basics For Beginners ACCOUNTING BASICS FOR BEGINNERS Module 1: Nature of Financial Accounting

Double-entry systems add assets, liabilities, and equity to the organization’s financial tracking. If you’re in charge of accounting, it’s not just numbers and receipts. It’s a process of gathering and reporting financial information.

- The presented basics of accounting only note the barest outline of the functions performed by the accountant.

- Accounts receivable, securities, and money market instruments are all common examples of liquid assets.

- If your accounting experience is limited to reconciling your checking account at the end of the month, you might not understand the difference between the cash accounting method and the accrual accounting method.

- Businesses and organizations use a system of accounts known as ledgers to record their transactions.

Accounting is the process of reporting, recording, interpreting, and summarizing financial transactions of any business entity. Debits and credits are used to record all of your small business bookkeeping and accounting transactions. The effect that a debit or credit has on a particular account is largely dependent on the account type being affected. Want to get seriously savvy with your business accounting, but don’t know where to start?

A business can also experience loss if the total expenses cost more than the amount of income that the business is bringing in over a set time. The assets that are recorded do not include any inventory that has been sold. A gain is on the income statement and it is under the non-operating and other revenue sections. It is the total amount of money the company makes from operations. Revenue is the amount of money generated by the sales of a company while income is the net profit minus any business expenses. You can outsource your accounting work to outside professionals who specialize in bookkeeping and tax preparation.

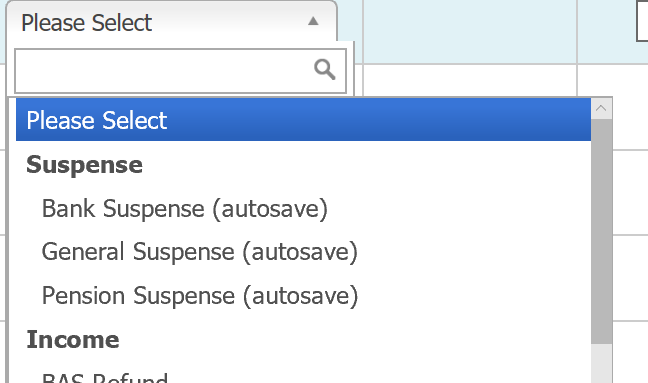

Examples include terms such as “accounts payable,” “accounts receivable,” “cash flow,” “revenue,” and “equity.” Regardless of how you manage your business accounting, it’s wise to understand accounting basics. If you can read and prepare these basic documents, you’ll understand your business’s performance and financial health — as a result, you’ll have greater control of your company and financial decisions. Every time you fill out one of these forms, the software automatically populates the accounts for you. The two types of accounting systems are single entry system and double entry system. The entry system is nothing but the process of recording a particular financial transaction in the firm’s books of accounts.

Basic accounting principles

If you are new to HBS Online, you will be required to set up an account before starting an application for the program of your choice. We expect to offer our courses in additional languages in the future but, at this time, HBS Online can only be provided in English. Regardless of where you log on or open up your textbook, completing coursework on a regular cadence will allow you to make steady progress toward your educational goal. Harvard Business School Online’s Business Insights Blog provides the career insights you need to achieve your goals and gain confidence in your business skills. INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more.

The whole point is to give you an idea of what’s working and what’s not working so that you can fix it. Synder’s customer support team is ready to help you 24/7 to improve efficiency and productivity of your debit memo! Try our free trial to see all the options available or schedule a demo session to see the whole process from the beginning to the very end explained by our experts. It provides a unique opportunity to enhance the way your software works without any additional effort of entering an endless stream of numbers. Synder automation will save you from all the difficulties you may encounter.

Zoho Books Review (2023): Features, Pros & Cons – Forbes

Zoho Books Review ( : Features, Pros & Cons.

Posted: Fri, 10 Feb 2023 08:00:00 GMT [source]

Let’s see how https://1investing.in/, Accounting, and Accountancy are different from each other. Customers, who buy the products and services that the business sells. Colin Barrow is an international property investor and author of Buying a Property in Eastern Europe For Dummies. John A. Tracy is a former accountant and professor of accounting. Thank you Dheeraj for this intuitive explanation of accounting with this nice story.

He assumes he will use some accounting software, but wants to meet with a professional accountant before making his selection. He asks his banker to recommend a professional accountant who is also skilled in explaining accounting to someone without an accounting background. Joe wants to understand the financial statements and wants to keep on top of his new business. His banker recommends Marilyn, an accountant who has helped many of the bank’s small business customers.

The Full Disclosure Principle requires accountants to disclose relevant financial information to any interested parties, particularly investors and lenders. This information must be disclosed either in the body of a financial statement, or in the notes at the end of that statement. As you study financial statements, you should aim to be able to create them on your own and be able to identify what all of the numbers on a certain statement mean. You can always look into courses at your local community college, or take online courses in accounting for free. Remember that financial accounting isn’t something you pick up overnight—it requires repeated application of the concepts you learn. With enough practice, you can recognize instances in your organization where your accounting knowledge can be applied.

The person is Joe Perez—a savvy man who sees the need for a parcel delivery service in his community. Joe has researched his idea and has prepared a business plan that documents the viability of his new business. For example account ‘Cash’ which is part of assets, company A assigns account number ‘101’, or account ‘Rental Income’, company B assigns ‘405’ as the account number of the revenue. The accounts that must be memorized in basic accounting are as follows.